Environmental, social, and governance (ESG) scores are an insidious mechanism by which ideologically aligned influential interests represented by unelected supranational organizations are attempting to “reset” the global financial system to their advantage. This emerging design would circumvent national and individual sovereignty by altering traditional financial methods of assessing risk and debt / capital allocation. This attempted shift from “shareholder capitalism” to a “stakeholder collectivism” model hinges upon assigning companies, and soon individuals, arbitrarily determined ESG scores. These scores would mandate subjective, difficult-to-define, and equally difficult-to-evaluate metrics assessing one’s commitment to “climate” and “social justice” issues. [1] Essentially, poorly scored companies suffer reduced or altogether eliminated access to capital and credit, while highly scored companies receive “preferred status” capital in-flows via traditional capital and debt markets, in addition to tax credits, grants, access to “special financial vehicles,” preferential contracting, and potentially other yet-to-be-defined advantages through future legislation, executive action, or international treaty. [2]

ESG’s metrics have ostensibly been designed to combat systemic global problems such as climate change, racial inequality, and world hunger—in alignment with the United Nations’ Sustainable Development Goals.[3] In reality, these measures will simply centralize power and control in the hands of unelected technocrats and private global institutions influenced solely by the wealthy elite who control monetary policy, capital, and credit through global central banks, where “baskets of currencies” make up the current global system. ESG is a major step toward consolidating a unitary global governance model utilizing digital identification and central bank digital currencies (CBDCs) as micromanagement tools that can be isolated upon individual transactions. ESG would therefore be a major step towards the dissolution of free markets, national sovereignty, due process under the law, and individual liberty.

Below is a brief summary of how ESG is being weaponized against farmers, food production, and the agricultural industry as a whole.

Many of ESG’s metrics, primarily those related to imposing environmental controls, are directly linked to the agricultural industry and food production.[4] Examples of some of these metrics include: “Paris-aligned GHG emissions targets,” “Impact of GHG [greenhouse gas] emissions,” “Land use and ecological sensitivity,” “Impact of air pollution,” “Impact of freshwater consumption and withdrawal,” “Impact of solid waste disposal,” and “Nutrients”—which, despite its innocuous-sounding name, is a metric that forces companies to estimate the “metric tonnes of nitrogen, phosphorous, and potassium in fertilizer consumed.”[5] Farmers and food producers use chemical fertilizers and pesticides for crop growth, in addition to producing waste biproducts, consuming substantial quantities of water, using vast swathes of land, and releasing what climate alarmists claim to be planet-ending carbon dioxide emissions.

Essentially, farmers, food producers, and other businesses involved with agricultural production and transportation are being coerced into ESG compliance, which necessitates elevating sustainability objectives above their own financial well-being—particularly damaging to an industry with razor-thin profit margins. As the ESG system dictates, those who do not transform their business model will suffer from reduced or eliminated access to capital and investment, and will lose access to any tax credits, subsidies, grants, or contracts at the hands of an array of public / private regulatory authorities.[6] As such, a company’s decision is “comply or die,” even though compliance may very well result in eventual financial insolvency.

The problems with ESG compliance extend beyond agricultural producers. This blind focus upon “solving” climate change inherently reduces the quantity of food supplied, which has myriad deleterious effects upon society. For one, there is simply less food available to feed people, in a world where billions are already struggling to put food on the table. ESG compliance raises food prices and exacerbates overall inflationary pressures, during a time in which inflation is already at a 40-year high. And, it naturally curtails individual choice and behavior, as many commodities cannot be produced without affecting the climate.

There are already multiple real-world examples of the chaos and damage ESG-related sustainability endeavors have wrought, with the catastrophe that has unfolded in Sri Lanka being one of the most salient. The Sri Lankan government embraced ESG at the urging of international organizations, introducing a ban on chemical fertilizers in April 2021 and signing on to a green finance taxonomy with the International Finance Corporation in May 2022 that further committed Sri Lanka to organic fertilizers.[7] Crop production subsequently decreased by approximately 50 percent,[8] resulting in complete social, economic, and political collapse amidst food shortages, energy blackouts, and hyperinflation.

A similar situation is unfolding in the Netherlands, which is attempting to remain compliant with the European Union’s stringent ESG mandates. The government of the Netherlands—the world’s second largest agricultural exporter—announced plans for a 70 percent decrease in nitrogen pollution by 2030 based on the country’s “illegally high” emissions apparently caused by livestock and chemical fertilizers.[9] Many Dutch farmers and ranchers were forced out of business due to these draconian policies, and tens of thousands have protested the government’s heavy-handed regulations.[10]

The global elites and institutions responsible for ESG are proceeding with their destructive and authoritarian agenda, notwithstanding the societal consequences. This was clearly illustrated at the World Economic Forum’s 2022 summit in Davos, which incorporated dozens of panels, conferences, and meetings related to reinforcing the global commitment to ESG. In one panel, Svein Tore Holsether—president and CEO of Yara International and one of the leading advocates of a centrally planned agricultural industry—said: “We have a food system that is only focused on kilos produced, not environmental impact, productivity, nutritional content, water consumption, carbon sequestration…that’s been disregarded.”[11]Holsether’s fellow panelist Leanne Geale—general counsel of Nestle, and another leading voice of the “sustainability” scheme—discussed how science and technology can be used to track crop growth and ensure the environment is not harmed in the process: “One [example] is remote assessment technology. Satellite monitoring…Another is digital sensors. A third is blockchain. We are able to follow, in the Congo, the coffee bean cherries from harvest all the way to the final product. We’re doing that through blockchain and QR codes.”

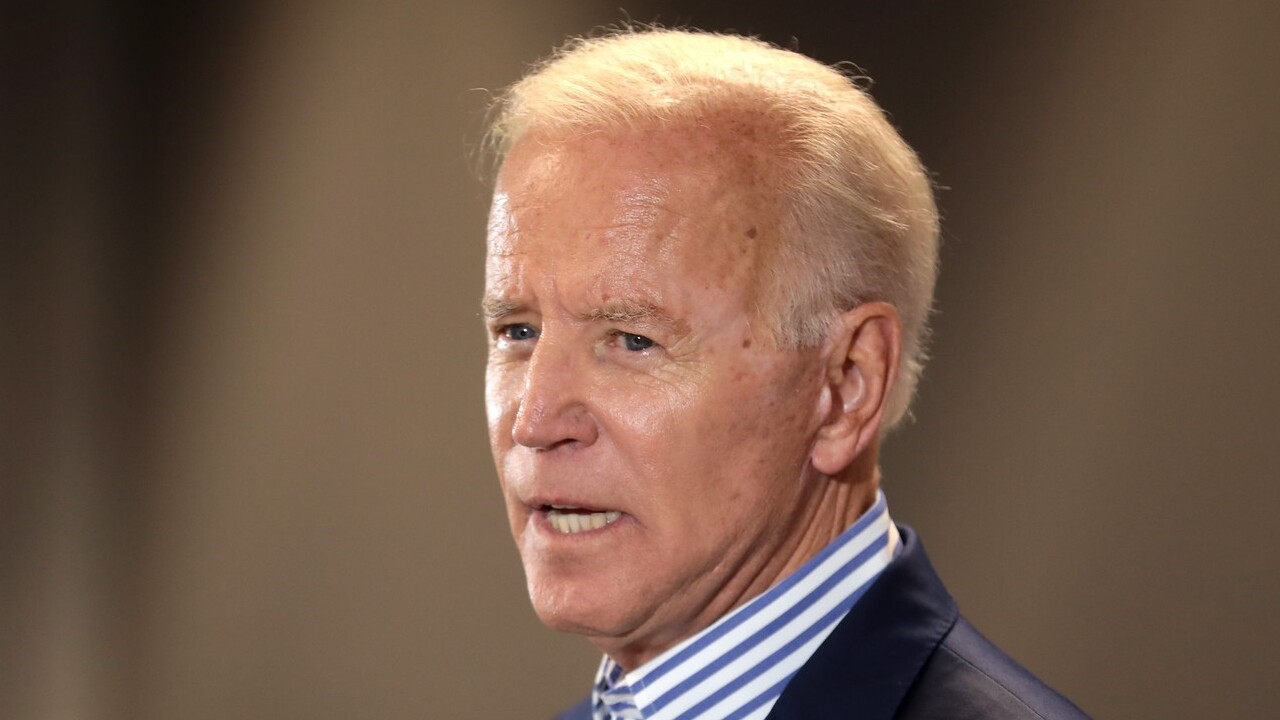

Taking cues from the EU and supranational international organizations, many western governments are falling in line with the sustainability agenda and institutionalizing ESG within their regulatory frameworks. Canadian President Justin Trudeau recently announced his country would reduce fertilizer emissions by 30 percent by 2030, and 100 percent by 2050. Analysis suggests that just the 30 percent reduction would cost farmers approximately $10 billion, with Canada losing more than 160 million metric tons of canola, corn, and spring wheat.[12] As for the United States, President Biden is paying farmers to cease production on their land as part of the Conservation Reserve Program, which Biden intends to increase by 4 million acres to a total of 25 million.[13]

If it is not stopped, ESG will continue to collapse global food supply chains and cause a global food shortage, ultimately leaving countries, businesses, and individuals devastated in its wake.

[1] For more information, see: Justin Haskins and Jack McPherrin, “Understanding Environmental, Social, and Governance (ESG) Metrics: A Basic Primer,” The Heartland Institute, January 26, 2022, https://www.heartland.org/publications-resources/publications/understanding-environmental-social-and-governance-esg-metrics-a-basic-primer

[2] Mark Bergman et al., “Introduction to ESG,” Harvard Law School Forum on Corporate Governance, August 1, 2020, https://corpgov.law.harvard.edu/2020/08/01/introduction-to-esg

[3] United Nations, “Sustainable Development,” Department of Economic and Social Affairs, accessed July 12, 2022, https://sdgs.un.org/goals

[4] For a more detailed inspection of ESG’s metrics, see: The Heartland Institute, “ESG: A Simple Breakdown of its Components,” August, 2022, https://www.heartland.org/_template-assets/documents/esg/PolicyTipSheetESG1.pdf

[5] Jonathan Walter, “Toward Common Metrics and Consistent Reporting of Sustainable Value Creation,” World Economic Forum, September, 2020, http://www3.weforum.org/docs/WEF_IBC_Measuring_Stakeholder_Capitalism_ Report_2020.pdf

[6] For more discussion of the host of actors implementing this system and some of the regulatory authorities involved, see: The Heartland Institute, “ESG: Primary Architects and Implementers,” September, 2022, https://www.heartland.org/_template-assets/documents/esg/PolicyTipSheetESG4.pdf

[7] Micaela Burrow, “’Complete Collapse’: Here’s How ESG Destroyed One Nation’s Economy,” The Daily Caller, July 6, 2022, https://dailycaller.com/2022/07/06/complete-collapse-esg-destroyed-nations-economy/

[8] United Nations Office for the Coordination of Humanitarian Affairs, “Sri Lanka Food Security Crisis – Humanitarian Needs and Priorities 2022,” June 9, 2022, https://reliefweb.int/report/sri-lanka/sri-lanka-food-security-crisis-humanitarian-needs-and-priorities-2022-june-sept-2022-ensita

[9] Reuters, “Dutch gov’t sets target to cut nitrogen pollution, farmers to protest,” June 10, 2022, https://www.reuters.com/world/europe/dutch-govt-sets-targets-cut-nitrogen-pollution-farmers-protest-2022-06-10/

[10] Mike Corder, “EXPLAINER: Why are Dutch farmers protesting over emissions?” Associated Press, June 28, 2022, https://abcnews.go.com/Business/wireStory/explainer-dutch-farmers-protesting-emissions-85848026

[11] World Economic Forum, “Redefining Food Systems with Emerging Technologies,” Livestreamed Panel, Davos Annual Summit, 2022, https://www.weforum.org/event_player/a0P68000001Kd0vEAC/sessions/redefining-food-systems-with-emerging-technologies

[12] Jen Skerritt, “Trudeau Spars With Farmers on Climate Plan Risking Grain Output,” Bloomberg, June 27, 2022, https://www.bloomberg.com/news/articles/2022-07-27/trudeau-spars-with-farmers-on-climate-plan-cutting-fertilizer-grain-output

[13] H. Claire Brown, “The Biden Administration Will Pay Farmers More Money Not to Farm,” Governing, May 2, 2021, https://www.governing.com/now/the-biden-administration-will-pay-farmers-more-money-not-to-farm

Jack McPherrin (jmcpherrin@heartland.org) is a managing editor of StoppingSocialism.com, research editor for The Heartland Institute, and a research fellow for Heartland's Socialism Research Center. He holds an MA in International Affairs from Loyola University-Chicago, and a dual BA in Economics and History from Boston College.