The purpose of this post is two-fold. First, I want to give my subscribers a heads-up that tomorrow (Feb. 15, 2023) I’ll be releasing a new video, “Why Is the Federal Reserve Provoking a Financial Crisis?” I’m shooting for noon eastern time, but we’ll see how the timed-publication feature on YouTube works out.

As usual, the video will be mirrored on Bitchute and Odysee, but I’ll probably put it out on Rumble too, since there’s a decent chance that the custom thumbnail image (different than the above) and/or the content itself will get censored. We’ll see. If YouTube takes a video down after it’s been mirrored elsewhere, do the mirrored clones get taken down too? I doubt it, but I don’t know that. So Rumble is my insurance policy since I manually upload select things there and deliberately avoid mirroring.

I’ll write a separate substack post for the video that amplifies the description box on YouTube etc. I’ll provide the video links in tomorrow’s substack post.

“Why Is the Federal Reserve Provoking a Financial Crisis?” is a hoss, clocking in at 46+ minutes. I put more work than usual into this one, including a complete transcript that I straight-typed (almost 7000 words). I also put together time-stamped chapter/topic markers, which will appear—in theory—in the description boxes.

This video builds on and extends the explosive (but largely overlooked AFAIK) analysis done by Chris Whalen, “Is JPMorgan Chase Insolvent?” But I take the analysis quite a bit further than Chris did, in large part because he published his comparatively shorter piece a few days before the F.D.I.C. released its Quarterly Banking Profile for 3Q2022 , which contained some eye-popping tells that didn’t reach Whalen’s eyes in time.

The second purpose of this post is to amplify a topic that I touch on in the video, and that’s what Klaus Schwab and his platoon of corporate brown nosers at the World Economic Forum might have in store for us. As it turns out, they’ve provided some big clues, which I’ll get to in a minute. To lay some groundwork for that discussion, though, let me say more about the video.

“Why Is the Federal Reserve Provoking a Financial Crisis?” makes the case that we are right now hurtling into a very serious financial crisis. In fact, it appears we are entering a new era in which the Federal Reserve is no longer coming to the aid of the banks at the first sign of distress. That’s not to say that the Fed won’t eventually intervene and try to control the inevitable crisis. I’m damn near certain it will.

But the era of knee-jerk bailouts by the Fed is over. As the video (like Whalen’s post) shows, the banking industry is dead broke. Moreover—and Whalen doesn’t get into this—the banks have already started to borrow huge sums of money in a panic. In the run-up to the flashpoint of previous crises, the Fed’s response to the first whiff of panic in the retail banking sector has been immediate; actually, as the video shows, the Fed seems to be fully aware of the panic well ahead of the actual flashpoint.

Now, however, the Fed appears to be not only perfectly content to let banks go ahead and panic, it is in fact actively dunking those banks even deeper underwater with interest rate increases. The next crisis, when it inevitably hits, promises to be spectacular.

That brings me back to the topic at hand, which is what Klown & the Gang might have planned in the way of the next pre-formatted sci-fi horror show that will draw attention away from huge problems with the doe-ray-me. This of course is a matter of rank speculation, so let the betting begin. I encourage readers to let it rip with their opinions in the comments.

I see three big clues as to how Klown & the Gang’s next production might play out: (1) what happened during the pandemic (hereinafter, PANDEMIC!!!), (2) official acknowledgment (by both Treasury and the Fed) that U.S. debt is on an unsustainable path (and that extraordinary measures are needed to rein it in), and (3) the recent annual meeting in Davos of Klown & the Gang discussing global risks that lie ahead.

1. PANDEMIC!!! Provided Air Cover for the Fed’s Crony QE Bonanza

Like a magician’s trick, PANDEMIC!!! wasn’t one event, it was two. The conscious event (covered by the media) was the 24/7 production starring the Virus. The sleight of hand (ignored by the media) was the Fed’s multi-trillion dollar Friends-of-the-Fed aka Hello-Larry asset purchase program. It is crucial to any magic trick’s success that the two events—the distraction and the real action—occur simultaneously. And thus was the case with PANDEMIC!!!

Indeed the timing of PANDEMIC!!!’s arrival was simply astonishing insofar as the cover it provided for the biggest monetary event of all time, which went largely unnoticed as a result, even by alleged financial mavens. At most, various mainstream and near-mainstream voices acknowledged that a huge wealth transfer had occurred, but never discussed, at least not publicly, whether that wealth transfer was planned in advance. Short answer: of course it was. But acknowledging that possibility is forbidden among those who seek or rely on mainstream approval.

As noted, the timing was remarkable. The World Health Organization declared a worldwide pandemic on March 11, 2020. That is exactly, as in, within a single day of, when the Federal Reserve began the process of more than doubling its balance sheet over the course of the next year. The unprecedented size of the Fed’s monetary blast was immediate, too, adding $1.75 trillion to its balance sheet—a 40% increase—in just the first four weeks of PANDEMIC!!!

• the Fed added $241 billion to its balance sheet during the week beginning March 11, 2020

• the Fed added $507 billion to its balance sheet during the week beginning March 18, 2020

• the Fed added $605 billion to its balance sheet during the week beginning March 25, 2020

• the Fed added $393 billion to its balance sheet during the week beginning April 1, 2020

As a reminder, the Fed expands its balance sheet by creating new money and using it to buy assets (from its buddies like Larry Fink). During PANDEMIC!!!, moreover, the Fed bought assets from non-banks and thereby expanded not just its own balance sheet but the balance sheet of retail banks as well, which the Fed itself finally admitted after I released 3 or 4 videos pointing out as much. This is where the inflation originated.

Both PANDEMIC!!! and the twin multi-trillion-dollar explosion of both the Fed’s and retail banks’ balance sheets were wholly unprecedented. Tellingly, however, neither event came out of the blue (as mainstream dogma would have it). Rather, each event was telegraphed by the powers that be from New York a few months in advance.

a. The Fed’s radical actions in March 2020 actually started in September 2019 with its response to the repo market meltdown

The overnight market for repurchase (or “repo”) agreements—where banks sell assets at night and buy them back the next morning (thus avoiding the appearance of taking out huge emergency loans)—melted down starting the week of September 9, 2019. Up until that week, the Fed had been shrinking its balance sheet by letting bonds roll off, meaning simply that when bonds expired (sort of like when you make your final mortgage payment), the Fed didn’t replace them. Between January 2018 and September 2019, the Fed’s balance sheet declined by over 15%, or $680 billion.

But during that fateful week in September 2019, for whatever reason—and I’ve yet to see a single explanation that doesn’t raise twice as many questions as it answers—all hell broke loose in the repo market, and the Fed stepped in big-time, purchasing assets. The Fed did this like it does anything else that involves spending money—it creates the money out of thin air, books it as liability, and hands that money to banks in exchange for assets, which then appear as new assets on the Fed’s balance sheet (to counterbalance the new liability). By January 1, 2020, the Fed had supplied half a trillion dollars of liquidity to the banks, unraveling in a few weeks its entire 18-month effort to reduce its balance sheet.

The Fed’s intervention in the repo market didn’t end when PANDEMIC!!! premiered in March 2020, but rather continued into June 2020. What changed in March was the addition of other, far bigger assets purchase programs, which eventually obviated the need for overnight repo funding.

Make no mistake about it: the Fed’s asset purchasing bonanza started in September 2019, not in March 2020. The chart of the Fed’s balance sheet alone leaves no room for dispute about this.

b. PANDEMIC!!! had a full dress rehearsal in October 2019, and thus the media had its PANDEMIC!!! talking points down in advance

The PANDEMIC!!! talking points that we’ve all heard ad nauseam for three relentless years did not in any way evolve naturally as some virus wended its way around the globe. Instead the talking points were scripted and rehearsed in advance, and then one big dress rehearsal was held, recorded and disseminated widely.

This is why public health intermeddlers, corporate minions and media amoebae alike all sound exactly like each other when it comes to Covid: they’re simply aping and riffing on what they saw in the PANDEMIC!!! dress rehearsal. These people had a choice: read from the PANDEMIC!!! script like a good sock puppet and get media coverage and money, or do your own thinking and be ignored or fired. For the mediocrities entrenched throughout the western corporatocracy, it was an easy choice. Many of them have spent decades avoiding original thought, and their wooden presentations fully reflect as much.

The big PANDEMIC!!! dress rehearsal was held on October 18, 2019 in New York and billed, benignly, as “Event 201.”

Event 201 was sponsored and hosted by the Bill & Melinda Gates Foundation, which never met a vaccine it didn’t like, along with Johns Hopkins University. The event was a recorded drill in which participants from public health organizations, private corporations and (notably) the media read from cue cards in acting out their responses to “a [purely hypothetical] new coronavirus spread[ing] silently within herds” of pigs.

After PANDEMIC!!!’s dress rehearsal was published on November 4, 2019, and the actual production began in January 2020, the only job for members of the live PANDEMIC!!! production team was to act out their correspoding roles from the rehearsal. It’s a rote assignment of the most pedestrian sort—endlessly parroting the same talking points, however ridiculous—and explains the base level of talent on display throughout the ordeal. It also explains why the version of the “real” coronavirus at the center of the live PANDEMIC!!! production is a carbon copy of Event 201’s scripted coronavirus, from symptoms to transmission vectors to openly advocating censorship of and punishment for anyone who dared to deviate from the script.

Just a few examples will suffice.

In the live production of PANDEMIC!!!, the media coverage followed the 24/7 saturation model—exactly as it did in the dress rehearsal.

In the live production of PANDEMIC!!!, the media and suddenly-ubiquitous “fact checkers” complained non-stop about the danger that “misinformation” posed for controlling Almighty Virus–lifted flawlessly from the dress rehearsal. Like good brown shirts, participants openly leveled bald threats.

In the live production of PANDEMIC!!!, “experts” were trotted out to make absurdly overblown projections of viral dangers—just as the dress rehearsal taught them.

And on and on.

To be clear, these dress rehearsals had nothing to do with reality, nor could they have: Event 201 was held well before the origin of the virus as even the legend itself had it. The dress rehearsal served another function altogether, namely, ensuring that the corporate dimwits tasked with selling the narrative during the live production of PANDEMIC!!! stayed on script.

The live production of PANDEMIC!!! was an unqualified success. The vast majority of people, including most observers in the financial space, have absolutely no clue about what the Fed did throughout the big show.

Today, as the debt-based monetary system comes apart at the seams—at least in late stage western-denominated currencies—you would have to be out of your mind not to expect an attempted repeat of the 1-2 sleight of hand that started in early 2020. The question isn’t whether there will be another meltdown like the repo crisis; there will be. The question is what event will be served up to distract attention away from the real problem. All I can say is, pay attention to “drills” and the like.

2. Repeated warnings from Treasury and the Fed alike about unsustainable U.S. debt

The unsustainability of U.S. debt is another constraint, like a boundary condition in math, that in my opinion will influence the coming psychodrama.

Yeah, yeah, yeah, I know: you’ve heard ominous warnings about U.S. debt levels for 30-odd years. It’s the Boy Who Cried Wolf, right? Well, yeah, exactly: the tragedy of the Boy Who Cried Wolf is that the wolf eventually showed up and ate the sheep while townsfolk blithely ignored the boy’s cries. That’s where the U.S. is now: the grim debt mauler has arrived, and it’s gonna get ugly.

The wolf in our case is this: annual tax revenues no longer cover interest on the debt plus non-negotiable spending like social security and medicaid—much less the rest of the federal budget.

Those social welfare programs aren’t technically contractual obligations, but they’re damn sure the result of a social contract between the U.S. government and its citizens: you pay in to the social welfare system when you’re young and healthy and making money; and when you’re old and frail you draw out of the system, it takes care of you. That’s a big reason those payments are non-negotiable. Another reason is that cutting those programs might spook U.S. creditors and push up interest rates, which would only exacerbate the problem.

When you add the technical interest rate payment to the non-negotiable spending (an interest-payment-like expenditure), the total interest rate payment of the U.S. was creeping up inexorably, and was bound to overtake U.S. tax revenue. When that happens, it’s ball game: once you have to borrow money just to make an interest payment, it’s over, mathematically speaking, because your debt level is now going to rise geometrically over and above your revenue. I made a whole video about this called, “Ur Federal Reserve cancer Rx is ready for pickup.”

That was almost a year ago. Since then the Fed has raised interest rates several times, and now the technical interest payment by itself on U.S. debt is double what it was back then, and is currently north of $850 billion now.

Here are the bullet points from that video that are germane to the next Klown show:

• historically, when countries go past the tipping point (interest payment bigger than revenue), they try to inflate their way out of the problem by printing money, which in our debt-based monetary system only makes things worse; and

• specifically in the U.S., the Treasury has repeatedly warned that draconian cuts are in store for the social welfare programs; good luck with those

All in all, I think you can count on eventual rate cuts by the Fed as the U.S. tries to inflate its way out its debt problem (which originates more fundamentally from creating money as debt than it does from any spending addiction as the problem is often cast).

Speaking of debt-based money, there’s a dark horse in this field that you need to know about. Because money is created as debt and sits as a liability on bank balance sheets, one way for money-issuing entities like commercial banks to get out of trouble is to simply cut liabilities across the board. In the case of a commercial bank, cutting deposits will do the trick. That happened in Cyprus in 2013. It’s called a bail-in since it’s coming from inside the bank (taking money out of people’s accounts, to reduce liabilities) rather than outside the bank (taking money from the outside, say, the Treasury, to increase assets).

Bail-ins are definitely in cards that are on the table. The powers that be have repeatedly floated proposals to this effect, i.e., at the retail level. I cover one example in “Sticky Fingered Fed Fanatic Omarova – the Wrong Kind of Bank Boss.”

So we have a runaway debt problem that’s already here, and we have proposals floating around about how to deal with too much debt that involve, not laying a finger on the financial powers that be, but instead involve inflicting as much pain on Main Street as is necessary to curb inflation. Given what we’ve seen since the bailouts, it doesn’t take much imagination to surmise how that one is likely to play out.

3. Handicapping the Apocalypse Derby—the WEF tote boards

Imagine for a minute that another financial crisis hits, like the repo crisis in September of 2019. We know exactly what happened, and in short order, once that meltdown occurred: we were treated to PANDEMIC!!!

Now, I’ll be the first to admit that we might be in store for PANDEMIC TWO!!! The first one worked, right? How many people do you know who are even vaguely aware that there was a problem deep inside the aortic valve of the world’s financial system just weeks before PANDEMIC!!! started? I know only a couple folks outside of the people I’ve expressly informed in person, and most of them remain deeply skeptical because it hasn’t been reported on TV. (Richard Nixon nailed that one.)

But let’s say the criminals running the system decide to abandon PANDEMIC TWO!!! and cast a brand new fear porn star, casting poor old worn-out Virus aside. Who’s it gonna be the big star this time? Where do we even start?

Cue Klown & the Gang, who meet every year in Davos. And every year they publish an entire handbook of cutting edge fear porn, 2023 was no exception. No, really—it’s 100 pages long, like a Sears Catalog for corporate creeps.

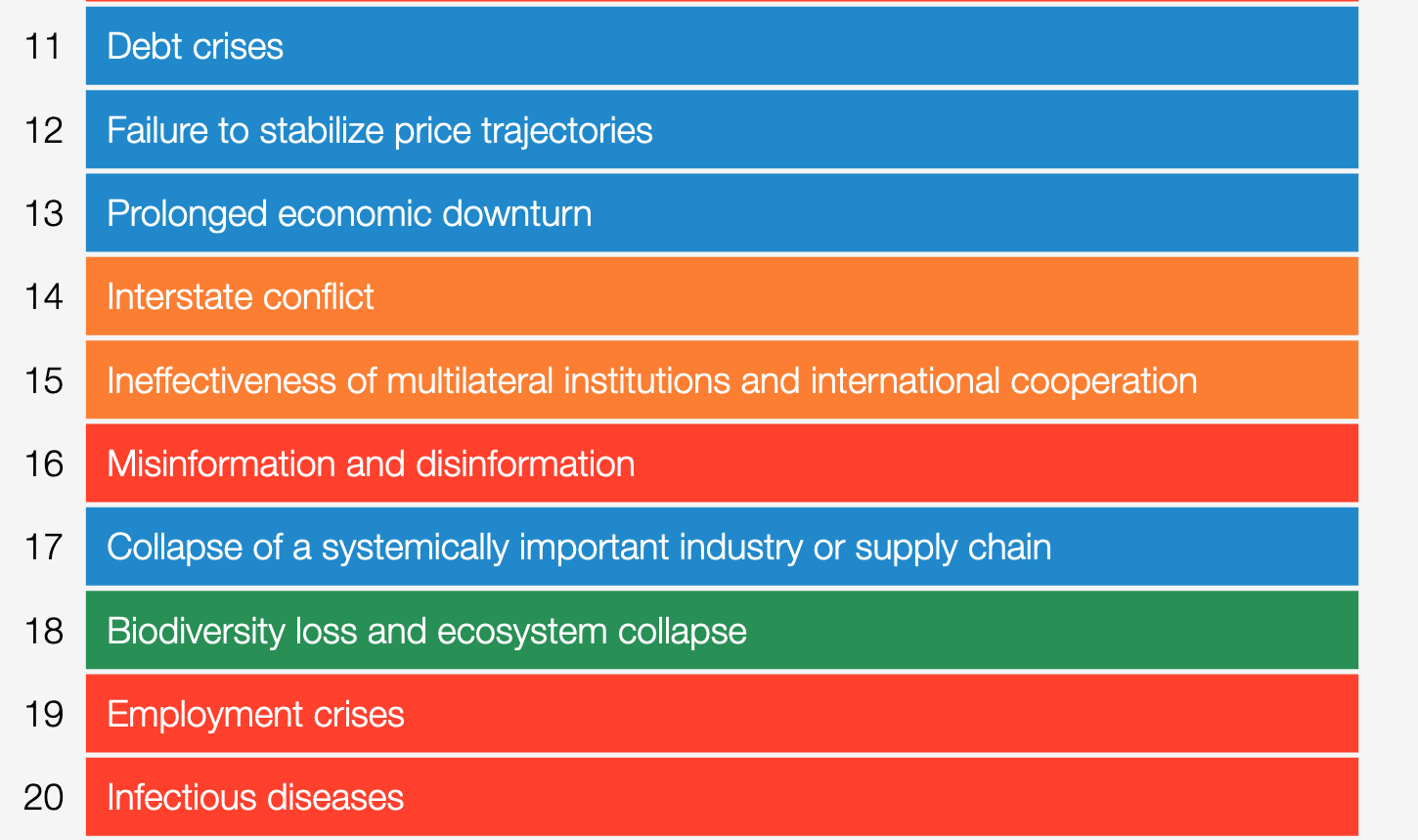

Here are this year’s top 30 contenders, which are risks on the 2-year horizon according to p. 11 of the WEF Global Risks Report:

So make your selections from the tote boards, or submit your own write-in entries. I’m all ears. Myself, I’m picking the 8-horse, Widespread Cybercrime. I think I even remember an actual horse with a name like that from some racetrack like Santa Anita.

In any case, I think the 8-horse is a solid pick. Wanna know why half your dough vanished from your bank account while you slept last night? Why, it was Widespread Cybercrime! And if you suggest otherwise on Twitter, you’re going to jail for sedition.

Lemme know in the comments section what you think. And hurry up, because the next financial crisis is on its way. That’s what tomorrow’s video is about.

First published at Best Evidence’s Substack page.

Image by 7CO, Attribution 2.0 Generic (CC BY 2.0).